Why Are HOA Fees So High

Why are your Homeowners Association (HOA) fees so high? It’s essential to understand the factors that contribute to these costs. Costly maintenance contracts, mismanagement of funds, and personal connections in awarding contracts can all drive up fees.

To determine if your fees are reasonable, research other buildings in the area and assess the value for money provided by contractors. If your fees are excessive, consider reviewing the budget, proposing changes as a board member, and evaluating the financial reserves.

Let’s dive into why HOA fees can be so high and how you can deal with them effectively. (Learn How To Get Around HOA Rental Restrictions)

Understanding the Nature of Homeowners Association (HOA) Fees

Do you ever wonder what an HOA fee is and how it is computed? Are you curious about the difference between HOA fees and condo fees? And why homeowners are required to pay these fees in the first place?

This discussion will delve into these key points and explore why some HOA fees are higher than others. So, let’s get started and unravel the nature of homeowner’s association fees together.

What Exactly Is an HOA Fee?

An HOA fee is a monthly payment made by homeowners to cover the utilities, repairs, amenities, and maintenance costs in a community association. These fees can sometimes be high due to various factors.

The primary reason for high HOA fees is the need to cover the expenses of maintaining common areas and providing necessary services. Additionally, unexpected expenses or the need to impose special assessments can contribute to higher fees.

It’s important to understand these reasons when considering why HOA fees may be so high and how they impact homeowners’ financial situations.

How Is the HOA Fee Computed?

To compute the HOA fee, you’ll need to consider factors such as the size of your unit, the amenities provided by the community, and any additional services or maintenance required.

Condo HOA fees can be high for various reasons, including maintenance and repairs, excessive financial reserves, mismanagement of funds by the HOA board, and awarding contracts based on personal connections instead of price and quality.

It’s essential to research average HOA fees in your area for comparability before determining if prices are too high.

The Difference between HOA Fees and Condo Fees

You may be wondering about the distinction between HOA fees and condo fees.

HOA fees refer to the monthly costs paid by homeowners in a community association for building maintenance, amenities, and other shared expenses.

On the other hand, condo fees are specific to condominium owners and cover maintenance costs for common areas within the building.

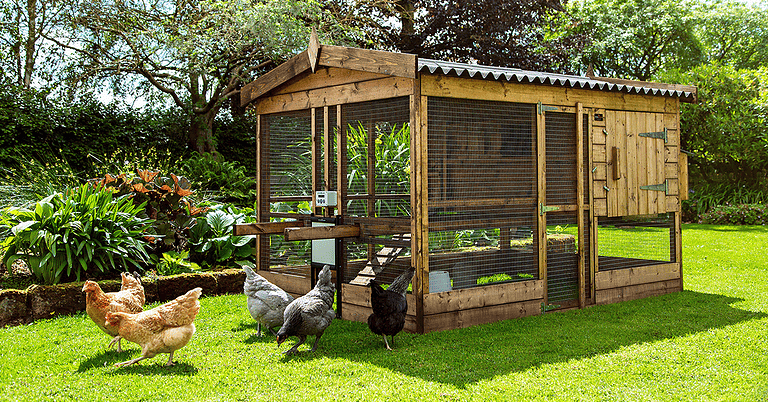

High HOA or association fees can result from extensive building maintenance needs, expensive amenities, or mismanagement of funds by the HOA board. (Read Can HOA Ban Chickens In Texas)

Why Homeowners are Required to Pay HOA Fees

Understanding the reasons behind requiring homeowners to pay HOA fees can provide insight into the financial responsibilities of living in a community association.

Homeowners association fees, also known as monthly dues or maintenance fees, cover various expenses such as utility costs, maintenance and repairs, and other monthly expenses.

These fees can vary depending on factors like the size of the community, amenities provided, and the sales price of the properties within the association.

Why Some HOA Fees Are Higher Than Others

Consider researching the factors that contribute to varying levels of HOA fees. Some HOA fees are higher than others due to several reasons.

Factors such as the size of the community, amenities provided, age and condition of the buildings, and financial reserves can all impact the cost of HOA fees. Additionally, mismanagement of funds by the HOA board or awarding contracts based on personal connections instead of price and quality can lead to higher prices.

Understanding these factors can help homeowners make informed decisions about their investment in an HOA community.

Factors Contributing to High HOA Fees

When considering the factors contributing to high HOA fees, it’s essential to examine the impact of amenities on these fees and how they are used for the maintenance of common areas.

Additionally, home repairs play a significant role in determining the sum of HOA fees, and understanding how reserve funds are utilized in setting these fees is crucial. Furthermore, the size of the condominium or building can also influence HOA fees, making it essential to analyze all these factors when evaluating the costs associated with homeowners association membership.

The Impact of Amenities on HOA Fees

Amenities like pool maintenance and landscaping contribute to high HOA fees. The impact of extras on costs is significant, as they require regular upkeep and maintenance. The HOA board allocates funds for common areas, including the reserve fund for unexpected expenses. Energy-efficient features like solar panels or efficient HVAC systems can also drive up costs.

Additionally, strict rules and regulations ensure the proper use and maintenance of amenities like fitness centers, adding to the overall expenses.

HOA Fees and the Maintenance of Common Areas

Maintaining common areas can significantly drive up HOA costs. The homeowners association (HOA) maintains these shared spaces, such as lobbies, hallways, and recreational facilities. Owners’ fees to the HOA include monthly maintenance expenses for these areas.

The board reviews the budget and determines how much each unit owner should contribute to these costs. Therefore, maintaining common areas is a crucial factor in determining why HOA fees can be so high.

How Home Repairs Influence the Sum of HOA Fees

When buying a home or property in a condo building, it’s crucial to understand how home repairs can influence the sum of HOA fees. As a condo owner, you’ll be responsible for your unit’s maintenance, but certain repairs may fall under the purview of the HOA.

These repairs include structural issues, plumbing or electrical problems, and standard area maintenance. The cost of these repairs is typically factored into the monthly mortgage payment and overall HOA fees.

It’s advisable to consult with a real estate attorney or conduct thorough research before purchasing an investment property to ensure you know potential repair costs and their impact on HOA fees. (Read Can HOA Enter Your Backyard)

The Role of Reserve Funds in Setting HOA Fee

To better understand the role of reserve funds in setting your HOA fee, it’s essential to consider factors such as the number of units, the age of the building, and ongoing maintenance planning and management.

Reserve funds play a crucial role in ensuring enough funds are available for unexpected expenses and major repairs. By maintaining adequate reserves, HOAs can avoid sudden fee increases or special assessments, which can contribute to high HOA fees.

How the Size of the Condominium or Building Affects HOA Fees

The size of the condominium or building directly impacts how much homeowners have to pay in HOA fees. More significant buildings with more units typically require more maintenance and upkeep, resulting in higher prices for owners.

Additionally, more significant buildings often offer more amenities and shared spaces that need to be maintained, further increasing the cost of HOA fees.

Potential buyers need to consider these factors when working with a real estate agent and calculating their monthly mortgage payments for owning a condo in a larger building.

How Can a Homeowner Deal with High HOA Fees?

When faced with high HOA fees and restrictions (CC&Rs), there are several strategies you can employ to address the issue. Firstly, consider communicating with the HOA board to understand better how your fees are allocated and if there is room for negotiation or reduction.

Additionally, seeking legal advice from a real estate attorney can provide insight into any potential legal avenues you may have to challenge or negotiate your fees. Furthermore, getting assistance from a real estate agent can help you explore different payment options and potentially find alternative housing options with lower HOA monthly fees.

Communicating with the HOA Board

Make sure you communicate your concerns and suggestions directly to the HOA board. It’s important to understand that your HOA fees are included in your monthly dues and cover various expenses.

The HOA consists of a board that manages these fees and makes decisions regarding their allocation. When considering buying a property that is part of an HOA, it’s crucial to research its associated fees, including how they are determined based on factors such as the number of shares or units.

New buyers should know what to expect to pay and understand that the HOA may adjust fees over time.

Seeking Legal Advice from a Real Estate Attorney

If you’re unsure about legal matters related to your HOA, it’s recommended that you seek advice from a real estate attorney. They can guide on various issues, such as understanding the rules and regulations of the HOA, reviewing contracts before purchasing a home, and resolving disputes with the board or other homeowners.

Seeking legal advice ensures you have all the necessary information to make informed decisions and protect your rights as a homeowner in an HOA community.

Getting Assistance from a Real Estate Agent

If you’re wondering why HOA fees are so high, it’s essential to consider the factors contributing to these costs. For example, in a single-family home, the fee covers various expenses such as maintenance, repairs, and amenities.

Additionally, older buildings may require more frequent and costly upkeep, such as installing a new boiler or replacing carpeting. HOAs often collect fees from many homeowners to cover these expenses and may even place liens on properties if payments are not paid.

Exploring Different Payment Options

Exploring different payment options can help you manage your financial obligations to the HOA. You can ensure timely and efficient payments by considering alternative payment methods, such as setting up automatic withdrawals or opting for online banking.

Additionally, some HOAs may offer installment plans or discounts for paying in advance. It’s crucial to analyze the available options and choose the one that best fits your financial situation and preferences. Taking proactive steps in managing your HOA fees can help alleviate financial burdens and maintain a positive relationship with your homeowner’s association.

The Possibility of Lowering HOA Fees

Consider researching and proposing cost-saving measures to the HOA board to explore the possibility of lowering your monthly payments.

Start by analyzing the current budget and identifying areas where expenses can be reduced. Look for opportunities to renegotiate contracts for maintenance and repair services, ensuring you get the best value for your money.

Additionally, consider implementing energy-efficient practices that can help lower utility costs over time. (Learn How Much Does It Cost To Decontaminate A House)

What to Consider When Buying a Home with High HOA Fees

When considering buying a home with high HOA fees, there are several vital points. First, it’s essential to understand the fees and whether they align with your needs and expectations.

Second, comparing HOA fees with single-family homes and condos in the same area can provide valuable context for assessing their reasonableness. Finally, evaluating the financial health of an HOA is crucial as it can impact the stability and quality of services provided.

Assessing the value for money and considering the future value of the property are additional factors to consider when making this decision.

Understanding What the Fees Include

Understanding what the fees include is crucial in determining why HOA fees are so high. HOA fees typically cover utilities, repairs, amenities, and maintenance costs. These fees help maintain property value and save costs for homeowners.

However, some factors contribute to higher fees, such as excessive contracts for maintenance and repair, mismanagement of funds by the HOA board, and extreme financial reserves being built up.

It’s essential to assess whether the services provided justify the high fees and research comparable fees in the area before judgment.

Comparing HOA Fees with Single-Family Homes and Condos

If you’re comparing HOA fees with single-family homes and condos, it’s essential to research and understand the factors contributing to the varying costs. Factors such as the number of units in the condominium, the building age, financial reserves, ongoing maintenance planning, and management can all affect HOA fees.

Additionally, fees may vary based on location. By comparing these factors with other buildings in the area, you can better understand why HOA fees may be higher or lower in some instances.

Evaluating the Financial Health of an HOA

To assess the financial health of an HOA, you should review the budget, inquire about reserve fund levels, and evaluate how money has been spent.

Analyzing the budget will help you understand where funds are allocated and if there is any excessive spending. Inquiring about reserve fund levels is essential to ensure they are sufficient for emergencies and unexpected expenses.

Evaluating how money has been spent will help determine if it has been used efficiently and effectively in maintaining the community and providing necessary services.

Assessing the Value for Money

When assessing the value for money, you should compare contractors’ services and determine if they offer sufficient quality and worth. Look at maintenance schedules, service contracts, and ongoing management. Research other buildings to get a rough idea of reasonable fees. Avoid relying on random HOA fees without ensuring comparability.

Consider if the services provided by contractors are still needed and offer value for money.

Considering the Future Value of the Property

The previous subtopic discussed assessing the value for money regarding HOA fees. Now let’s shift our focus to considering the property’s future value.

It’s important to remember that high HOA fees can contribute to your property’s long-term value. By maintaining shared spaces and amenities and handling necessary repairs, HOAs help preserve property values and ensure a desirable living environment.

So while high fees may seem burdensome in the short term, they can ultimately benefit your investment in the long run.

The Pros and Cons of High HOA Fees

When considering the pros and cons of high HOA fees, it’s essential to consider how they can benefit you as a homeowner. High prices often indicate that the HOA can provide extensive amenities and services, such as well-maintained common areas, landscaping, security, and even recreational facilities. These benefits can enhance your quality of life and increase the value of your property.

However, there are also drawbacks to consider. One is the financial burden of paying higher fees each month. Another is the potential for increased restrictions on your property. Additionally, high HOA fees can impact a home’s resale value. While some buyers may be willing to pay more for access to desirable amenities, others may be deterred by the higher costs.

It’s also worth noting that not all HOAs with high fees offer the same level of service or amenities. Characteristics such as location, community size, management efficiency, and financial reserves can vary significantly among different associations.

If you face unfair or excessive HOA fees, knowing how to address the situation effectively is essential. Understanding your rights as a homeowner and actively participating in your association’s decision-making processes can help ensure you are treated fairly.

The Benefits of High HOA Fees

High HOA fees can provide homeowners access to well-maintained amenities and ensure the preservation of property values. These fees contribute to the maintenance and upkeep of shared spaces, such as pools, gyms, and parks, which enhance the overall quality of life in a community.

Additionally, high HOA fees often indicate that the association is financially stable and able to handle any unexpected expenses or repairs that may arise. So, while they may seem costly, these fees offer valuable benefits for homeowners.

The Drawbacks of High HOA Fees

One drawback of high HOA fees is that they can strain homeowners’ budgets. When HOA fees are excessively high, homeowners can find it challenging to afford other necessary expenses. According to data, the average fee for a single-family homeowner is around $250 per month. However, prices can range from $10 to $4,000 per month depending on various factors such as location and amenities provided.

It’s essential for homeowners to carefully consider their budget and assess whether the benefits outweigh the financial burden.

How High HOA Fees Influence a Home’s Resale Value

Now let’s explore how high HOA fees can influence the resale value of a home. When potential buyers are considering a property, one of the factors they consider is the cost of HOA fees. High fees may deter buyers or reduce their purchasing power, ultimately affecting the demand for properties within that community.

Additionally, homes with lower HOA fees may be more attractive to buyers and command higher resale values. Considering this impact when evaluating a property’s affordability and investment potential is essential.

Characteristics of HOAs With High Fees

The characteristics of HOAs with high fees can vary depending on factors such as mismanagement, excessive financial reserves, and awarding contracts based on personal connections instead of cost and quality. These HOAs may show signs of poor budget planning, lack of transparency in financial decisions, and a disregard for the best interests of homeowners.

It is essential to analyze these factors when considering the value and affordability of an HOA with high fees.

How to Deal with Unfair or Excessive HOA Fees

To deal with unfair or excessive HOA fees, you can request a copy of the budget to review how your money has been spent. Analyze the expenses and ensure they align with the services provided. Consider becoming a board member to propose changes and gain access to documents.

Assess if services provided by contractors are still needed and offer value for money. Take action to protect your financial interests within the HOA community.

Conclusion

In conclusion, understanding the reasons behind high Homeowners Association (HOA) fees is crucial for homeowners. Factors such as costly maintenance contracts, mismanagement of funds, and personal connections in contract awards can contribute to inflated costs.

It is essential to assess whether the fees are proportional to the services provided and compare them with other buildings in the area. Homeowners should review budgets, propose changes as board members, and evaluate the value for money from contractors.

Additionally, factors like the number of units, age of the building, vacant units, and financial reserves play a role in determining HOA fees. Striking a balance between sufficient funds for emergencies and avoiding excessive accounts that lead to high prices is essential.

Ultimately, homeowners must weigh the pros and cons before purchasing a property with high HOA fees.